Blue Cross Enrollment for Employees Who Previously Waived CoverageBlue Cross will allow a medical, dental and vision group special enrollment period (SEP) for fully insured and small business funding groups choosing to participate. This SEP event is in light of the COVID-19 pandemic and is intended to allow employees on groups to enroll that are not currently serving a group established eligibility waiting period and had previously waived group coverage. Here are the details:

1 Comment

Just 11 days away! If you have not made your Open Enrollment appointment or finished your 2020 insurance enrollment with us, you are running out of time! To help us out, please send us your best estimate for your 2020 household income so we can get updated rates to you and help you with your 2020 plan selection. D O Y O U Q U A L I F Y F O R A. T A X C R E D I T ? Here are a few of the rules:

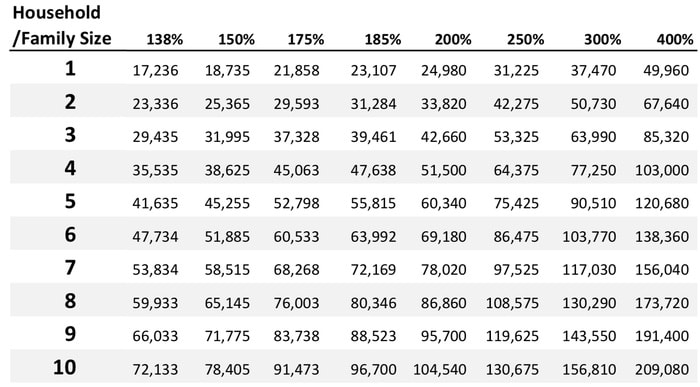

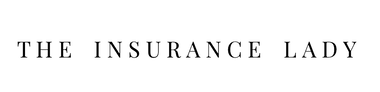

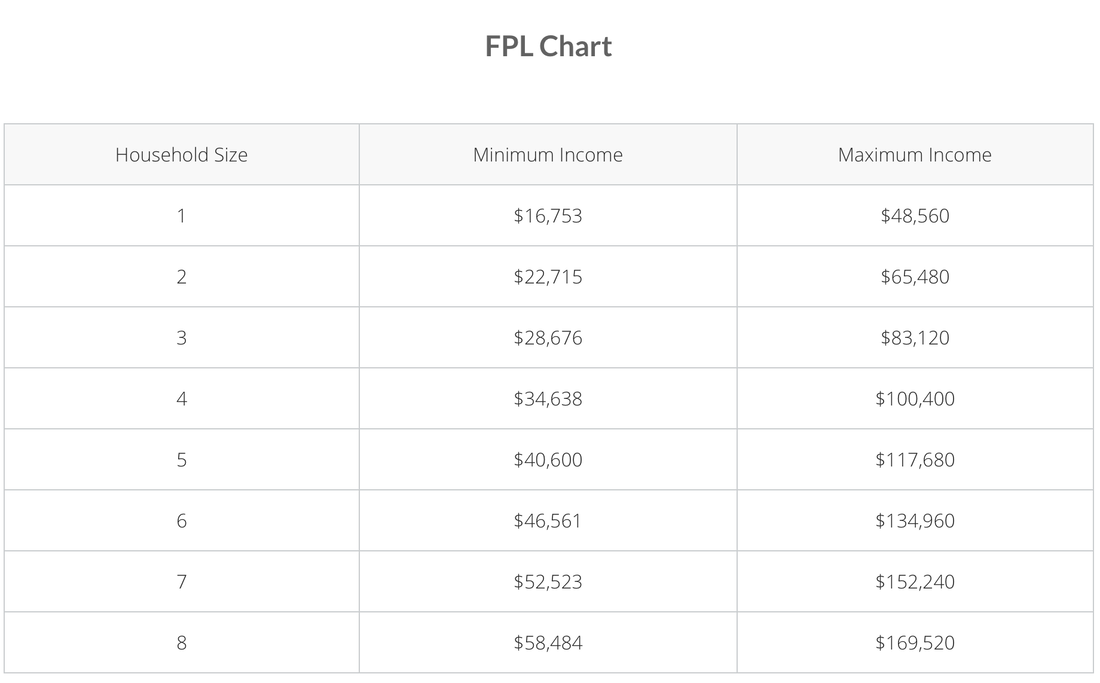

We are about half way through this year already! We just wanted to touch base with you and make sure that you are en route to make the 2019 income we estimated during Open Enrollment last year. Below you will see the absolute MOST you can make per household size in order to prevent owing back your entire tax credit when you file your 2019 taxes. Maximum Annual Income to Receive a Marketplace Tax CreditIF YOU THINK YOU WILL MAKE MORE THAN THE ALLOWED AMOUNT FOR YOUR HOUSEHOLD SIZE:We NEED to make changes to the amount of tax credit you are accepting per month so that you DON'T owe it back in a lump sum at the end of the year when you file your taxes.

Please let us know where you stand in relation to the chart and please tell us if we need to make changes! Open Enrollment for Individuals starts |

MARKETPLACE (ACA) PLANS

HEALTH CARE MINISTRY SHARING PLANS

ACCIDENT/CRITICAL ILLNESS GAP PLANS

| SHORT TERM PLANS

HUSBAND/WIFE GROUP PLANS

|

WARNING:

DO NOT GO TO HEALTHCARE.GOV ALONE

Health Insurance is so complicated and confusing. If done wrong, it WILL mess you up for the rest of the year. Please let our team of professionals help guide you to the best option for you and your family at NO ADDITIONAL COST to you.

1. KNOWLEDGE

When you require legal advice, you contact a lawyer, and when a health issue arises, you visit your doctor, so when you need assistance with your insurance coverage, you need to use an industry expert. In addition to having many years of experience in the industry, independent insurance agents work with many different insurance companies and are knowledgeable about their individual strengths. Although one insurance company may provide unmatched claims service, another may offer more competitive rates. Based on what is most important to you, an independent agent will find the best match for you.

- We write 1,000’s of policies each year and know the quickest way to get in and out of the system.

- We know the insurance lingo – we are the experts.

- We know which plans are best within each company.

- We do the research and leg work for you. We study the plans each year BEFORE talking to you.

- We know the Louisiana insurance market. The MarketPlace does not, nor are they licensed insurance agents.

2. CUSTOMER SERVICE

If you have coverage questions or worse, need help with a claim, would you rather reach an automated recording or an actual person when you call? More and more companies have switched to automated systems, often making it difficult and time consuming to reach the right person. However, at many independent insurance agencies, an actual person will still greet and assist you.

- We make sure you get the benefits you need.

- We want a long-term relationship with you.

- We are there to assist you all year long. You have one point of contact and one person to help you solve any issues that may arise.

3. PERSONAL SHOPPERS

Working with an independent insurance agent can be compared to having a personal shopper. Similar to the way in which a real estate agent sorts through properties to help you find your ideal home, an insurance agent reviews many different insurance companies’ rates and coverage options to help you secure policies that best suit your needs. You may believe that this comes at an additional cost to you, but independent agents do not add extra charges to insurance companies’ rates. So you can choose to work with an independent agent, who will handle your coverage needs, assist you with claims and answer any questions you may have, from billing issues to coverage concerns, always advocating on your behalf, at no additional cost to you.

4. UNDERSTANDING

Independent insurance agents understand that insurance can seem complicated and confusing, especially when you don’t deal with it on a daily basis. For this reason, your insurance agent will work to ensure that you fully understand your coverage, from what is and is not included, to the deductibles, coinsurance and copayments. After you purchase your policies, an independent agent’s work isn’t over – instead, we are available year-round to help answer your questions, update your policy and make coverage recommendations.

5. REPUTATION

Reputation plays a crucial role in finding a company you can trust, and many independent agencies take pride in the years, if not decades, they have spent serving their local communities. Not only can a company’s many years of service speak to its well-established reputation in the community, but it can also help you feel confident about its financial stability. Although there are many different ways to obtain insurance, would you rather obtain a quote from a startup Internet-based insurance provider that advertised on television, or call a local agent who your friends, co-workers and neighbors could recommend?

6. PROTECTION & PEACE OF MIND

Above all, working with an independent insurance agent will provide you with peace of mind, knowing that when you save money on your insurance, it won’t come at the expense of comprehensive coverage. When it comes to protecting your home, family, business and other invaluable assets, relying on an independent agent you can trust is a great place to start.

Archives

June 2023

May 2023

October 2021

October 2020

March 2020

December 2019

November 2019

July 2019

May 2019

December 2018

November 2018

October 2018

September 2018

August 2018

July 2018

Categories

All

Blue365

BlueCare

Blue Cross

COVID-19

Fitness

Go365

Group Insurance

HAFA

Health Agents For America

Healthcare.gov

Health Insurance

Help

Humana

Insurance

Legislation

Long Term Care

Marketplace

Open Enrollment

Tax Credit

Telehealth

RSS Feed

RSS Feed