|

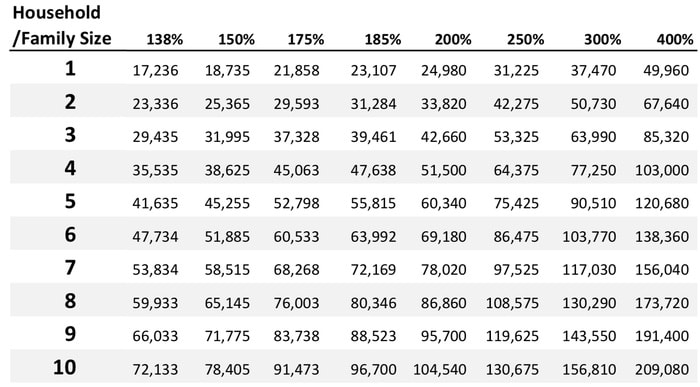

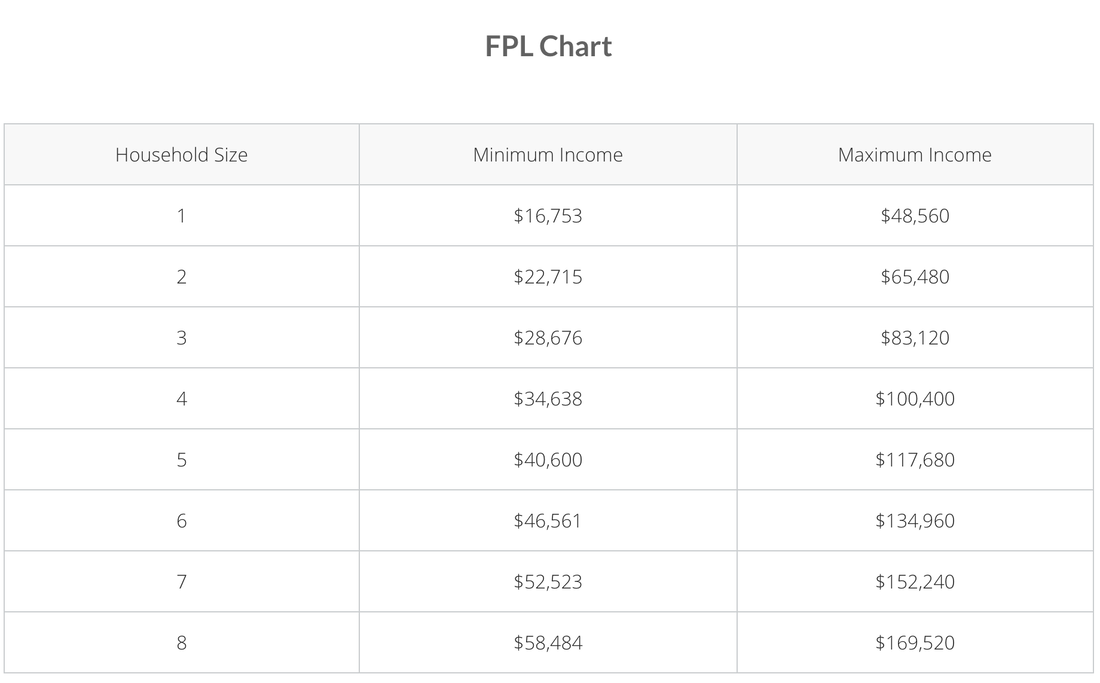

Just 11 days away! If you have not made your Open Enrollment appointment or finished your 2020 insurance enrollment with us, you are running out of time! To help us out, please send us your best estimate for your 2020 household income so we can get updated rates to you and help you with your 2020 plan selection. D O Y O U Q U A L I F Y F O R A. T A X C R E D I T ? Here are a few of the rules:

0 Comments

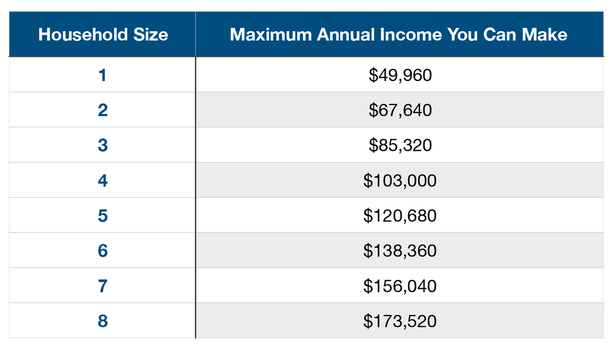

We are about half way through this year already! We just wanted to touch base with you and make sure that you are en route to make the 2019 income we estimated during Open Enrollment last year. Below you will see the absolute MOST you can make per household size in order to prevent owing back your entire tax credit when you file your 2019 taxes. Maximum Annual Income to Receive a Marketplace Tax CreditIF YOU THINK YOU WILL MAKE MORE THAN THE ALLOWED AMOUNT FOR YOUR HOUSEHOLD SIZE:We NEED to make changes to the amount of tax credit you are accepting per month so that you DON'T owe it back in a lump sum at the end of the year when you file your taxes.

Please let us know where you stand in relation to the chart and please tell us if we need to make changes! After having to break the news to 100's of clients, we thought it may be easier to send out an email to everyone. Blue Cross is sending out notices that your premiums are going down… and for some this is true. However, for most everyone this is not 100% accurate. If you currently have a subsidy from Healthcare.gov, Blue Cross did not factor in the CHANGE in your subsidy this year. The premiums are calculated on the 2018 subsidy and what we are finding is that 2019 subsidies are going down. When something seems too good to be true it's because it probably is. We hate to be the ones to break the bad news to you but wouldn’t you rather know the truth and pay the correct premiums now vs. owing back the subsidy during tax season 2020? I love surprises but not the ones that hit my pocketbook a year later.

We know you trust us and hope all of you know and understand we are just looking out for you. Please, please call to schedule your appointment with us today. Open Enrollment for Individuals starts |

MARKETPLACE (ACA) PLANS

HEALTH CARE MINISTRY SHARING PLANS

ACCIDENT/CRITICAL ILLNESS GAP PLANS

| SHORT TERM PLANS

HUSBAND/WIFE GROUP PLANS

|

WARNING:

DO NOT GO TO HEALTHCARE.GOV ALONE

Health Insurance is so complicated and confusing. If done wrong, it WILL mess you up for the rest of the year. Please let our team of professionals help guide you to the best option for you and your family at NO ADDITIONAL COST to you.

Health Agents for American (HAFA) stormed Capitol Hill last week and several of its top agents were invited to a round table discussion at Centers for Medicare & Medicaid Services (CMS), also known as The Federal Marketplace.

We were able to bring our concerns and experiences dealing with the Marketplace directly to the CMS staff.

The trip to Washington also provided us with the opportunity to hear from our legislators on healthcare issues that are currently being addressed in the Senate. According to HAFA President/CEO, Ronnell Nolan, "We learned about exciting legislation from Senator Bill Cassidy to fight balance billing."

Members of the bipartisan Senate health care price transparency working group, released draft legislation to protect patients from surprise medical bills. The draft bill is intended to jumpstart discussions in Congress about how to best stop the use of balanced billing to charge patients for emergency treatment or treatment provided by an out-of-network provider at an in-network facility.

Recent examples of patients receiving surprise medical bills referenced by HAFA include a patient who received a bill of nearly $109,000 for care after a heart attack, and a patient who received a bill for $17,850 for a urine test.

The discussion draft of the Protecting Patients from Surprise Medical Bills Act addresses three scenarios:

We were able to bring our concerns and experiences dealing with the Marketplace directly to the CMS staff.

The trip to Washington also provided us with the opportunity to hear from our legislators on healthcare issues that are currently being addressed in the Senate. According to HAFA President/CEO, Ronnell Nolan, "We learned about exciting legislation from Senator Bill Cassidy to fight balance billing."

Members of the bipartisan Senate health care price transparency working group, released draft legislation to protect patients from surprise medical bills. The draft bill is intended to jumpstart discussions in Congress about how to best stop the use of balanced billing to charge patients for emergency treatment or treatment provided by an out-of-network provider at an in-network facility.

Recent examples of patients receiving surprise medical bills referenced by HAFA include a patient who received a bill of nearly $109,000 for care after a heart attack, and a patient who received a bill for $17,850 for a urine test.

The discussion draft of the Protecting Patients from Surprise Medical Bills Act addresses three scenarios:

1. Emergency services provided by an out-of-network provider in an out-of-network facility:

The draft bill would ensure that a patient is only required to pay the cost-sharing amount required by their health plan, and a provider may not bill the patient for an additional payment. The excess amount above the cost-sharing amount will be paid by the patient’s health plan in accordance with an applicable state law or an amount based on the greater of the median in-network amount negotiated by health plans and health insurance issuers or 125 percent of the average allowed amount for the service provided by a provider in the same or similar specialty and provided in the same geographical area.

2. Non-Emergency services following an emergency service from an out-of-network facility:

The draft bill would ensure that if a patient receives an emergency service from an out-of-network health care provider or facility and requires additional services after being stabilized, the health care facility or hospital will notify the patient, or their designee, that they may be required to pay higher cost-sharing than if they received an in-network service and give the patient an option to transfer to an in-network facility. The patient, or their designee, would also be required to sign a written acknowledgment of that notification.

3. Non-Emergency services performed by an out-of-network provider at an in-network facility:

The draft bill would ensure that a health plan or out-of-network provider cannot bill a patient beyond their in-network cost-sharing in the case of a non-emergency service that is provided by an out-of-network provider in an in-network facility. The excess amount above the cost-sharing amount will be paid by the patient’s health plan in accordance with an applicable state law or an amount based on the greater of the median in-network amount negotiated by health plans and health insurance issuers or 125 percent of the average allowed amount for the service provided by a provider in the same or similar specialty and provided in the same geographical area.

No, I’m not running for office. That would be absurd. But I have been chosen to serve on a very elite board with other agents around the country. Approximately fifteen agents were chosen to serve as liaisons with CMS or as you know it… HealthCare.gov. The board discusses topics of concern, ways to improve, how to make the experience easier for the consumer, etc. We have made great strides this past year, and on Wednesday I head down to meet with Randy Pate, CMS Deputy Administrator and the Director of the Center for Consumer Information and Insurance Oversight.

I won’t bore you with all the details but I do want to ask if you have any concerns or comments regarding Healthcare.gov and the MarketPlace. Good experiences? Bad ones? I would love to hear back from you and will be happy to report any and all concerns. Believe me, I have plenty to talk about since I’ve worked through most of them with all of you, but do you have any of your own that you want me to bring to the table?

Feel free to email me, private message me, call me – whatever you’d like. Just let me know today or tomorrow because I head out on Wednesday. I can’t say it enough friends, it’s an honor and privilege to serve all of you! My life wouldn’t be the same without you!

I won’t bore you with all the details but I do want to ask if you have any concerns or comments regarding Healthcare.gov and the MarketPlace. Good experiences? Bad ones? I would love to hear back from you and will be happy to report any and all concerns. Believe me, I have plenty to talk about since I’ve worked through most of them with all of you, but do you have any of your own that you want me to bring to the table?

Feel free to email me, private message me, call me – whatever you’d like. Just let me know today or tomorrow because I head out on Wednesday. I can’t say it enough friends, it’s an honor and privilege to serve all of you! My life wouldn’t be the same without you!

Send me your Marketplace/Healthcare.gov comments or concerns!I am here to make your voice heard. If there is any experience with the Marketplace that you have had, I am hoping to give a report in order to make a positive change. |

FOLLOW US:

Archives

June 2023

May 2023

October 2021

October 2020

March 2020

December 2019

November 2019

July 2019

May 2019

December 2018

November 2018

October 2018

September 2018

August 2018

July 2018

Categories

All

Blue365

BlueCare

Blue Cross

COVID-19

Fitness

Go365

Group Insurance

HAFA

Health Agents For America

Healthcare.gov

Health Insurance

Help

Humana

Insurance

Legislation

Long Term Care

Marketplace

Open Enrollment

Tax Credit

Telehealth

RSS Feed

RSS Feed