|

The Insurance Lady is partnering with The Life of a Single Mom to give 1,000+ new books to children ages pre-k to 5th grade to promote childhood literacy and a promising '23-'24 school year.

The Life of a Single Mom has is serving 75 single mom-led families with back-to-school supplies, including 225 children with backpacks, supplies, planners, and the like. As you may know, school preparation is a tremendous financial burden for single mother-led families. Those supplies have already been provided. However, we'd like to also provide 5 new books per child to promote childhood literacy and a healthy school year launch.

0 Comments

FOR IMMEDIATE RELEASE

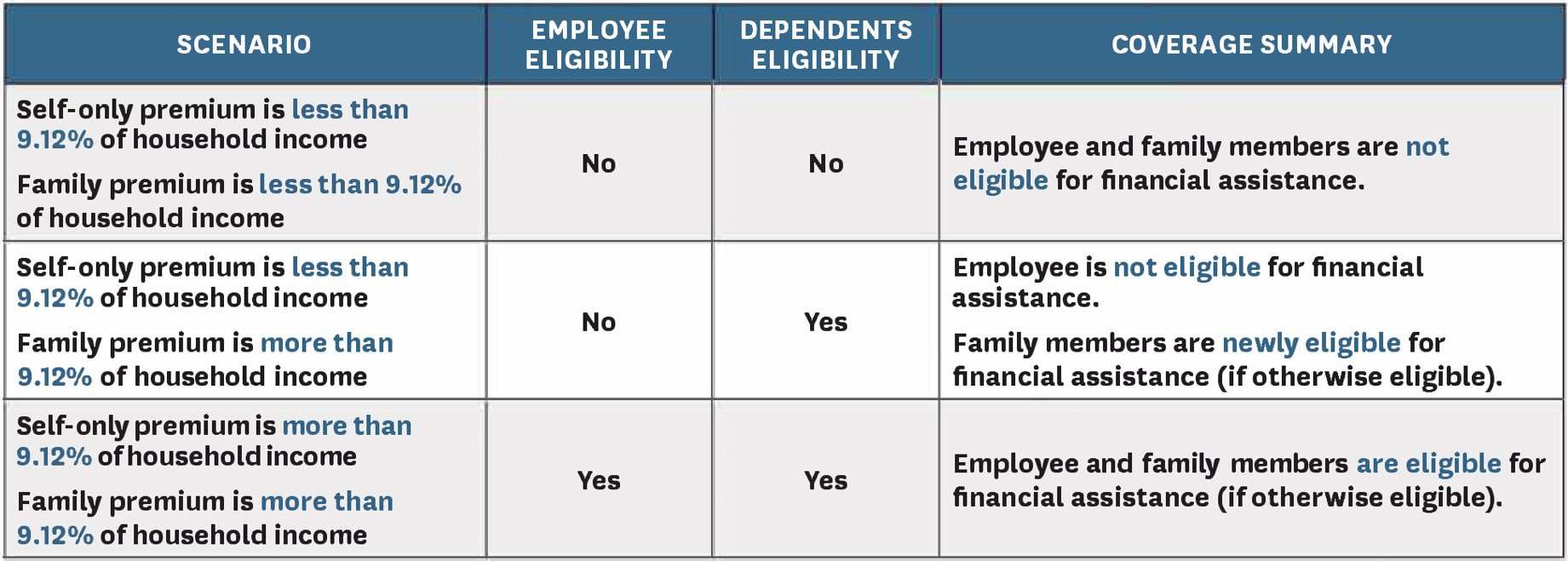

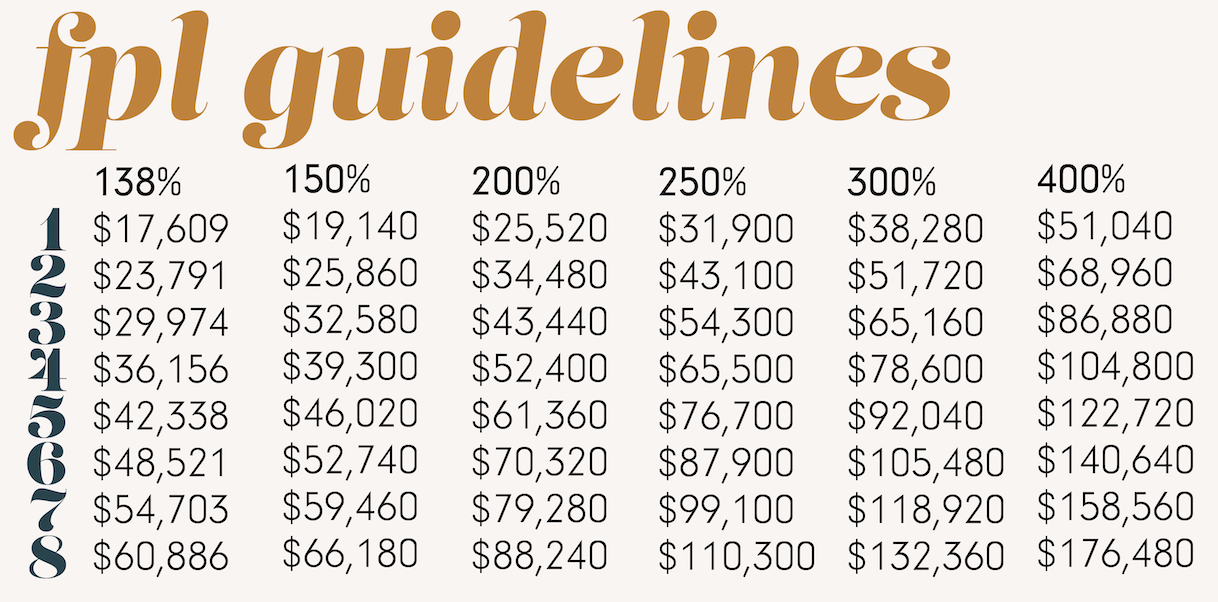

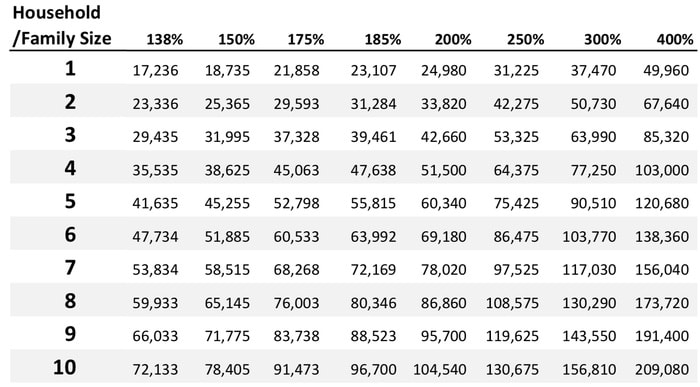

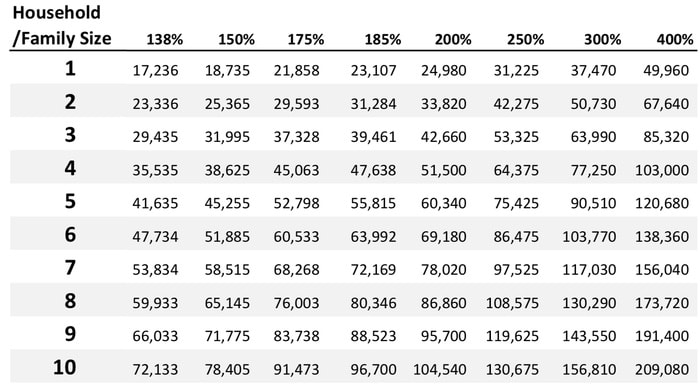

LOUISIANA - In light of the recent developments regarding Medicaid unwinding, Trish Freeman, The Insurance Lady, a trusted insurance agent for the past 30 years, wants to ensure that individuals and families have access to accurate information and guidance during this transition. As part of our commitment to supporting the community, we encourage those with questions or concerns to reach out to our team of licensed insurance agents who are well-versed in Medicaid and can provide the necessary assistance. The unwinding of Medicaid can be a complex process, and we understand that individuals may have various queries related to their healthcare coverage. Our licensed insurance agents are equipped with the expertise and knowledge to help navigate the intricacies of insurance options available in the wake of Medicaid changes. They can provide personalized guidance, answer questions, and offer clarity on topics such as eligibility requirements, coverage options, enrollment procedures, and any potential impacts on existing healthcare arrangements. At Trish Freeman Insurance Services, we firmly believe that access to accurate information is vital for making informed decisions about healthcare coverage. Our team of agents stay updated on the latest developments in the insurance industry, including changes to Medicaid and other public health programs. They undergo rigorous training and possess a deep understanding of the intricacies of insurance policies to ensure they can provide reliable advice tailored to each individual's unique circumstances. By contacting our office, individuals and families can gain peace of mind knowing they have a dedicated resource to turn to during this period of transition. Whether they are seeking alternatives to Medicaid or require guidance on finding the most suitable insurance plan for their specific needs, our agents will be available to provide comprehensive support every step of the way. For more information or to schedule a consultation with one of our licensed insurance agents, please call (225) 622-6554 or visit www.insurancelady.com. Our team is ready to assist and address any concerns related to Medicaid unwinding and its implications. About The Insurance Lady: Trish Freeman Insurance Services is a leading provider of insurance services, committed to helping individuals and families secure reliable healthcare coverage. With a team of licensed insurance agents dedicated to serving the community, we strive to deliver personalized assistance and expert advice. Our mission is to empower individuals to make informed decisions about their insurance needs, ensuring their peace of mind and protection. ### New rule fixes Affordable Care Act "Family Glitch"Increasing the number of individuals eligible for Marketplace coverage in 2023. Until now under the Patient Protection and Affordable Care Act (ACA), employer sponsored coverage was considered affordable for all family members to whom an employer's offer extends if the premium for the employee's self-only coverage was considered affordable. The premium required to cover family members was not considered. Beginning plan year 2023If an individual has an offer of employer-sponsored coverage that extends to their family members, the affordability of employer coverage for those family members will be based on the family premium cost, not the self-only premium cost. Family members will be eligible for financial assistance on the Marketplace if the employee's family premium cost is considered unaffordable and their income is within the limits. Family Marketplace EligibilityFor 2023, an employer-sponsored plan is considered affordable if it does not exceed 9.12 percent of household income. Options for covering your family

OPEN ENROLLMENTThe 2022 Open Enrollment period for Individuals purchasing health insurance is November 1st, 2021, - December 15th, 2021

HERE ARE A FEW THINGS YOU WILL NEED TO HAVE PREPARED:

IF YOU DON'T QUALIFY FOR A SUBSIDY

DO NOT GO TO HEALTHCARE.GOV ALONE!

This is not directed toward Medicare/ Medicare supplement clients or those on an employer sponsored/group plan. ***Please make sure to set your appointment or fill out our online questionnaire so that we can update your application. Note: Many clients are receiving information from Blue Cross about 2021 premiums for their current plan. Any premium increase they send you is based off of your 2020 information. The rate increase they are sending may not be accurate.*** Remember: The 2021 Open Enrollment period for Individuals purchasing health insurance (outside of an employer) is November 1, 2020 through December 15, 2020Here are a few things you will need you to have prepared for our phone call appointment:

WHAT IF YOU DON'T QUALIFY FOR A SUBSIDY (TAX CREDIT)?If you don't have access to employer sponsored insurance and don't qualify for a subsidy, we can discuss a few other options to avoid the high cost of those ACA plans.

Husband/Wife Group Plans Do you own a business? An LLC? If you and your spouse are named on the Business Paperwork as co-owners, managers or members of the LLC, we can discuss a Group Plan for you. WARNING Do not go to Healthcare.gov alone!Health Insurance is complicated and confusing, and if done wrong, it has the potential to cause chaos for you and your family. Our services are FREE and our agency is among the ELITE Circle of Champions with HealthCare.gov so please let our team of professionals help guide you to the best option for you and your family. Plus, you have access to us all year long! We help with everything and we're happy to do so!

Blue Cross Enrollment for Employees Who Previously Waived CoverageBlue Cross will allow a medical, dental and vision group special enrollment period (SEP) for fully insured and small business funding groups choosing to participate. This SEP event is in light of the COVID-19 pandemic and is intended to allow employees on groups to enroll that are not currently serving a group established eligibility waiting period and had previously waived group coverage. Here are the details:

Just 11 days away! If you have not made your Open Enrollment appointment or finished your 2020 insurance enrollment with us, you are running out of time! To help us out, please send us your best estimate for your 2020 household income so we can get updated rates to you and help you with your 2020 plan selection. D O Y O U Q U A L I F Y F O R A. T A X C R E D I T ? Here are a few of the rules:

***Please make sure to set your appointment so that we can update your application. The premium increase from Blue Cross is too high, we can help lower it!***Remember: The 2020 Open Enrollment period for Individuals purchasing health insurance (outside of an employer) is November 1, 2019 through December 15, 2019 Here are a few things you will need you to have prepared for our phone call appointment:

WHAT IF YOU DON'T QUALIFY FOR A SUBSIDY (TAX CREDIT)?If you don't have access to employer sponsored insurance and don't qualify for a subsidy, we can discuss a few other options to avoid the high cost of those ACA plans.

Husband / Wife Group Plans Do you own a business? An LLC? If you and your spouse are named on the Business Paperwork as co-owners, managers or members of the LLC, we can discuss a Group Plan for you. WARNING |

Humana's Wellness Engagement Incentive (WEI)Humana’s Wellness Engagement Incentive (WEI) Recognition Program automatically earns premium credits for fully insured and Level Funded Premium (LFP) groups with fewer than 100 employees based on their engagement in Go365®. | Humana's Wellness Premium Discount (WPD)For fully insured groups with more than 100 employees, they’re automatically eligible for Humana’s Wellness Premium Discount (WPD). Through this discount program, groups can earn up to 8% discounts on their medical renewal rates as more of their employees reach Silver, Gold, or Platinum Status in Go365. | 7% premium credit for each Silver employeeThrough the WEI, these groups can earn A 7% premium credit for each employee who reaches Silver Status and a 15% premium credit for each employee who reaches Gold Status or higher. This video shows how easy it can be for employees to reach Silver Status in Go365 and start earning premium discounts. |

Learn more about Go365

Insurance Commissioner Jim Donelon issued a cease and desist order today to United HealthCare Services, Inc. and/or UnitedHealthcare Insurance Company, its subsidiaries and affiliates (collectively hereafter referred to as “United”) for their intention to implement the removal of producer commissions from upcoming renewals of certain group health insurance products.

“In reviewing this situation I found it necessary to order the company to stop all efforts to implement such policy and to revise all applicable schedules of commissions and relevant rate and form filings to appropriately reflect the full commission payment required by law,” Commissioner Donelon stated. “This action is meant to both protect Louisiana’s health insurance producers who are due compensation and preserve our authority in making sure insurers writing in Louisiana are in compliance with our laws.”

The Louisiana Department of Insurance (LDI) was contacted in May by numerous producers who indicated that they had been notified of United’s intention to implement a zero-dollar schedule of commissions applicable to all policies sold to groups of greater than 100 insureds with an effective date on or after September 1, 2019. Accompanying this notification was an inducement to work with United and affected insureds to negotiate a “replacement” agency fee to be paid by the insured to the producer and an offer by United to facilitate this payment.

According to insurancenewsnet.com Health Agents for America President/CEO, Ronnell Nolan said, “It’s really appalling because our members have been fighting to get paid, and that bill is important. Lowering health care costs is what we want for our clients. But our members aren’t getting commissions on the individual market and UnitedHealthcare is not even paying for groups of 50 and above. So how can anybody point the arrow toward our members and say we’re part of the problem? We’re not part of the problem. Agents have been losing money since the passage of the ACA."

“In reviewing this situation I found it necessary to order the company to stop all efforts to implement such policy and to revise all applicable schedules of commissions and relevant rate and form filings to appropriately reflect the full commission payment required by law,” Commissioner Donelon stated. “This action is meant to both protect Louisiana’s health insurance producers who are due compensation and preserve our authority in making sure insurers writing in Louisiana are in compliance with our laws.”

The Louisiana Department of Insurance (LDI) was contacted in May by numerous producers who indicated that they had been notified of United’s intention to implement a zero-dollar schedule of commissions applicable to all policies sold to groups of greater than 100 insureds with an effective date on or after September 1, 2019. Accompanying this notification was an inducement to work with United and affected insureds to negotiate a “replacement” agency fee to be paid by the insured to the producer and an offer by United to facilitate this payment.

According to insurancenewsnet.com Health Agents for America President/CEO, Ronnell Nolan said, “It’s really appalling because our members have been fighting to get paid, and that bill is important. Lowering health care costs is what we want for our clients. But our members aren’t getting commissions on the individual market and UnitedHealthcare is not even paying for groups of 50 and above. So how can anybody point the arrow toward our members and say we’re part of the problem? We’re not part of the problem. Agents have been losing money since the passage of the ACA."

Archives

June 2023

May 2023

October 2021

October 2020

March 2020

December 2019

November 2019

July 2019

May 2019

December 2018

November 2018

October 2018

September 2018

August 2018

July 2018

Categories

All

Blue365

BlueCare

Blue Cross

COVID-19

Fitness

Go365

Group Insurance

HAFA

Health Agents For America

Healthcare.gov

Health Insurance

Help

Humana

Insurance

Legislation

Long Term Care

Marketplace

Open Enrollment

Tax Credit

Telehealth

RSS Feed

RSS Feed