|

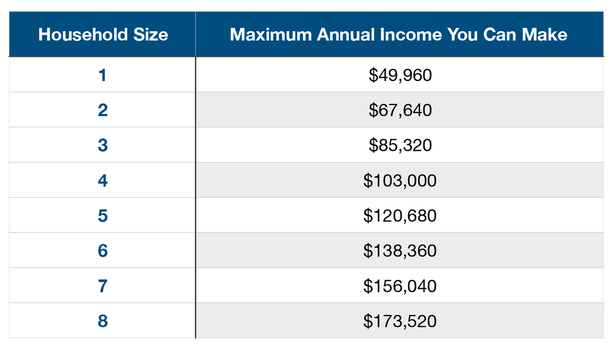

We are about half way through this year already! We just wanted to touch base with you and make sure that you are en route to make the 2019 income we estimated during Open Enrollment last year. Below you will see the absolute MOST you can make per household size in order to prevent owing back your entire tax credit when you file your 2019 taxes. Maximum Annual Income to Receive a Marketplace Tax CreditIF YOU THINK YOU WILL MAKE MORE THAN THE ALLOWED AMOUNT FOR YOUR HOUSEHOLD SIZE:We NEED to make changes to the amount of tax credit you are accepting per month so that you DON'T owe it back in a lump sum at the end of the year when you file your taxes.

Please let us know where you stand in relation to the chart and please tell us if we need to make changes!

1 Comment

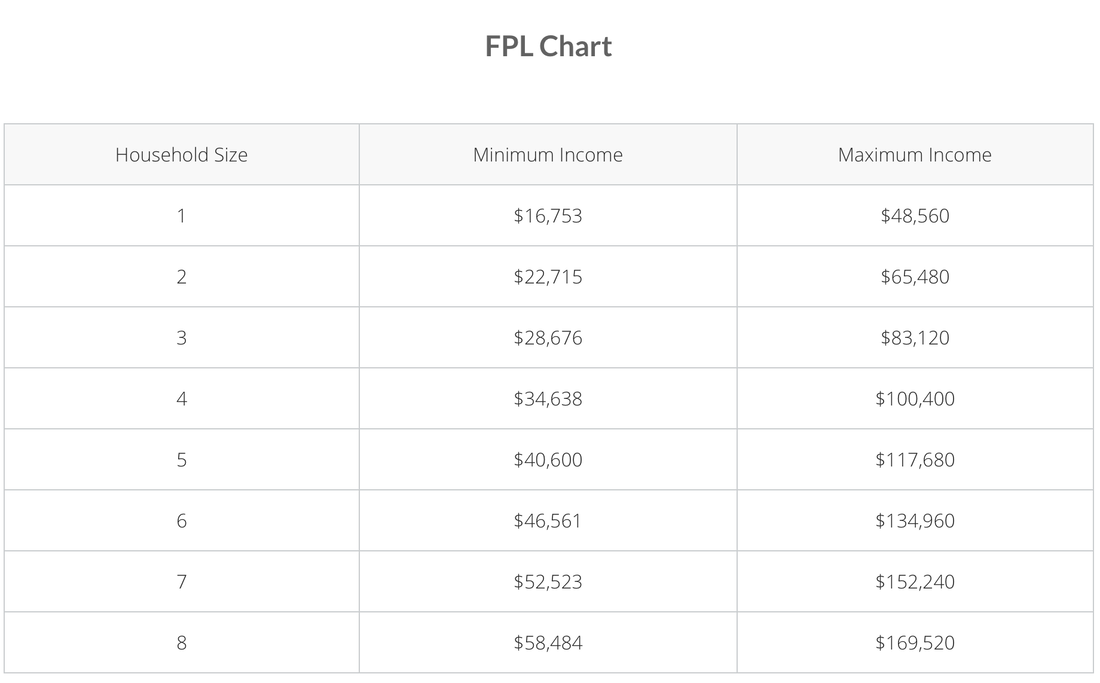

Trish had the opportunity to speak with CNN reporter, Tami Luhby, on the large number of clients switching from ACA plans to Short Term plans for 2019 and the difficulty most people are having getting through the underwriting process for these plans. Now that they won't be subject to a penalty, some of Trish Freeman's clients are more open to short-term plans. The Gonzales, La., agent is selling more of them this fall, though only to those with clean health histories. After having to break the news to 100's of clients, we thought it may be easier to send out an email to everyone. Blue Cross is sending out notices that your premiums are going down… and for some this is true. However, for most everyone this is not 100% accurate. If you currently have a subsidy from Healthcare.gov, Blue Cross did not factor in the CHANGE in your subsidy this year. The premiums are calculated on the 2018 subsidy and what we are finding is that 2019 subsidies are going down. When something seems too good to be true it's because it probably is. We hate to be the ones to break the bad news to you but wouldn’t you rather know the truth and pay the correct premiums now vs. owing back the subsidy during tax season 2020? I love surprises but not the ones that hit my pocketbook a year later.

We know you trust us and hope all of you know and understand we are just looking out for you. Please, please call to schedule your appointment with us today. Open Enrollment for Individuals starts |

MARKETPLACE (ACA) PLANS

HEALTH CARE MINISTRY SHARING PLANS

ACCIDENT/CRITICAL ILLNESS GAP PLANS

| SHORT TERM PLANS

HUSBAND/WIFE GROUP PLANS

|

WARNING:

DO NOT GO TO HEALTHCARE.GOV ALONE

Health Insurance is so complicated and confusing. If done wrong, it WILL mess you up for the rest of the year. Please let our team of professionals help guide you to the best option for you and your family at NO ADDITIONAL COST to you.

Health Agents for American (HAFA) stormed Capitol Hill last week and several of its top agents were invited to a round table discussion at Centers for Medicare & Medicaid Services (CMS), also known as The Federal Marketplace.

We were able to bring our concerns and experiences dealing with the Marketplace directly to the CMS staff.

The trip to Washington also provided us with the opportunity to hear from our legislators on healthcare issues that are currently being addressed in the Senate. According to HAFA President/CEO, Ronnell Nolan, "We learned about exciting legislation from Senator Bill Cassidy to fight balance billing."

Members of the bipartisan Senate health care price transparency working group, released draft legislation to protect patients from surprise medical bills. The draft bill is intended to jumpstart discussions in Congress about how to best stop the use of balanced billing to charge patients for emergency treatment or treatment provided by an out-of-network provider at an in-network facility.

Recent examples of patients receiving surprise medical bills referenced by HAFA include a patient who received a bill of nearly $109,000 for care after a heart attack, and a patient who received a bill for $17,850 for a urine test.

The discussion draft of the Protecting Patients from Surprise Medical Bills Act addresses three scenarios:

We were able to bring our concerns and experiences dealing with the Marketplace directly to the CMS staff.

The trip to Washington also provided us with the opportunity to hear from our legislators on healthcare issues that are currently being addressed in the Senate. According to HAFA President/CEO, Ronnell Nolan, "We learned about exciting legislation from Senator Bill Cassidy to fight balance billing."

Members of the bipartisan Senate health care price transparency working group, released draft legislation to protect patients from surprise medical bills. The draft bill is intended to jumpstart discussions in Congress about how to best stop the use of balanced billing to charge patients for emergency treatment or treatment provided by an out-of-network provider at an in-network facility.

Recent examples of patients receiving surprise medical bills referenced by HAFA include a patient who received a bill of nearly $109,000 for care after a heart attack, and a patient who received a bill for $17,850 for a urine test.

The discussion draft of the Protecting Patients from Surprise Medical Bills Act addresses three scenarios:

1. Emergency services provided by an out-of-network provider in an out-of-network facility:

The draft bill would ensure that a patient is only required to pay the cost-sharing amount required by their health plan, and a provider may not bill the patient for an additional payment. The excess amount above the cost-sharing amount will be paid by the patient’s health plan in accordance with an applicable state law or an amount based on the greater of the median in-network amount negotiated by health plans and health insurance issuers or 125 percent of the average allowed amount for the service provided by a provider in the same or similar specialty and provided in the same geographical area.

2. Non-Emergency services following an emergency service from an out-of-network facility:

The draft bill would ensure that if a patient receives an emergency service from an out-of-network health care provider or facility and requires additional services after being stabilized, the health care facility or hospital will notify the patient, or their designee, that they may be required to pay higher cost-sharing than if they received an in-network service and give the patient an option to transfer to an in-network facility. The patient, or their designee, would also be required to sign a written acknowledgment of that notification.

3. Non-Emergency services performed by an out-of-network provider at an in-network facility:

The draft bill would ensure that a health plan or out-of-network provider cannot bill a patient beyond their in-network cost-sharing in the case of a non-emergency service that is provided by an out-of-network provider in an in-network facility. The excess amount above the cost-sharing amount will be paid by the patient’s health plan in accordance with an applicable state law or an amount based on the greater of the median in-network amount negotiated by health plans and health insurance issuers or 125 percent of the average allowed amount for the service provided by a provider in the same or similar specialty and provided in the same geographical area.

No, I’m not running for office. That would be absurd. But I have been chosen to serve on a very elite board with other agents around the country. Approximately fifteen agents were chosen to serve as liaisons with CMS or as you know it… HealthCare.gov. The board discusses topics of concern, ways to improve, how to make the experience easier for the consumer, etc. We have made great strides this past year, and on Wednesday I head down to meet with Randy Pate, CMS Deputy Administrator and the Director of the Center for Consumer Information and Insurance Oversight.

I won’t bore you with all the details but I do want to ask if you have any concerns or comments regarding Healthcare.gov and the MarketPlace. Good experiences? Bad ones? I would love to hear back from you and will be happy to report any and all concerns. Believe me, I have plenty to talk about since I’ve worked through most of them with all of you, but do you have any of your own that you want me to bring to the table?

Feel free to email me, private message me, call me – whatever you’d like. Just let me know today or tomorrow because I head out on Wednesday. I can’t say it enough friends, it’s an honor and privilege to serve all of you! My life wouldn’t be the same without you!

I won’t bore you with all the details but I do want to ask if you have any concerns or comments regarding Healthcare.gov and the MarketPlace. Good experiences? Bad ones? I would love to hear back from you and will be happy to report any and all concerns. Believe me, I have plenty to talk about since I’ve worked through most of them with all of you, but do you have any of your own that you want me to bring to the table?

Feel free to email me, private message me, call me – whatever you’d like. Just let me know today or tomorrow because I head out on Wednesday. I can’t say it enough friends, it’s an honor and privilege to serve all of you! My life wouldn’t be the same without you!

Send me your Marketplace/Healthcare.gov comments or concerns!I am here to make your voice heard. If there is any experience with the Marketplace that you have had, I am hoping to give a report in order to make a positive change. |

FOLLOW US:

There have been reports that individuals are receiving robocalls across the country that falsely claim to be made by “Blue Cross and Blue Shield.” These calls may seek to market insurance products or collect personal information from call recipients. Blue Cross and Blue Shield of Louisiana is NOT making these calls.

If you receive one of these recorded calls claiming to be from Blue Cross and Blue Shield, there are tips you should follow:

If you receive one of these recorded calls claiming to be from Blue Cross and Blue Shield, there are tips you should follow:

- If you get a recorded call from a caller whom you did not authorize to call you, the call is likely fraudulent or malicious and you should hang up immediately.

- Do not respond to prompts to “press 1 to speak to the operator or get your name taken off the list,” and do not provide any personal information. If you respond, you’ll probably get more calls.

- Do not provide personal or financial information.

- It is advisable to block the numbers of the robocalls you receive from calling your cell phone, although these callers may continue to call you from other numbers or use “spoofing” technology that makes the same calls appear to come from different numbers.

1. KNOWLEDGE

When you require legal advice, you contact a lawyer, and when a health issue arises, you visit your doctor, so when you need assistance with your insurance coverage, you need to use an industry expert. In addition to having many years of experience in the industry, independent insurance agents work with many different insurance companies and are knowledgeable about their individual strengths. Although one insurance company may provide unmatched claims service, another may offer more competitive rates. Based on what is most important to you, an independent agent will find the best match for you.

- We write 1,000’s of policies each year and know the quickest way to get in and out of the system.

- We know the insurance lingo – we are the experts.

- We know which plans are best within each company.

- We do the research and leg work for you. We study the plans each year BEFORE talking to you.

- We know the Louisiana insurance market. The MarketPlace does not, nor are they licensed insurance agents.

2. CUSTOMER SERVICE

If you have coverage questions or worse, need help with a claim, would you rather reach an automated recording or an actual person when you call? More and more companies have switched to automated systems, often making it difficult and time consuming to reach the right person. However, at many independent insurance agencies, an actual person will still greet and assist you.

- We make sure you get the benefits you need.

- We want a long-term relationship with you.

- We are there to assist you all year long. You have one point of contact and one person to help you solve any issues that may arise.

3. PERSONAL SHOPPERS

Working with an independent insurance agent can be compared to having a personal shopper. Similar to the way in which a real estate agent sorts through properties to help you find your ideal home, an insurance agent reviews many different insurance companies’ rates and coverage options to help you secure policies that best suit your needs. You may believe that this comes at an additional cost to you, but independent agents do not add extra charges to insurance companies’ rates. So you can choose to work with an independent agent, who will handle your coverage needs, assist you with claims and answer any questions you may have, from billing issues to coverage concerns, always advocating on your behalf, at no additional cost to you.

4. UNDERSTANDING

Independent insurance agents understand that insurance can seem complicated and confusing, especially when you don’t deal with it on a daily basis. For this reason, your insurance agent will work to ensure that you fully understand your coverage, from what is and is not included, to the deductibles, coinsurance and copayments. After you purchase your policies, an independent agent’s work isn’t over – instead, we are available year-round to help answer your questions, update your policy and make coverage recommendations.

5. REPUTATION

Reputation plays a crucial role in finding a company you can trust, and many independent agencies take pride in the years, if not decades, they have spent serving their local communities. Not only can a company’s many years of service speak to its well-established reputation in the community, but it can also help you feel confident about its financial stability. Although there are many different ways to obtain insurance, would you rather obtain a quote from a startup Internet-based insurance provider that advertised on television, or call a local agent who your friends, co-workers and neighbors could recommend?

6. PROTECTION & PEACE OF MIND

Above all, working with an independent insurance agent will provide you with peace of mind, knowing that when you save money on your insurance, it won’t come at the expense of comprehensive coverage. When it comes to protecting your home, family, business and other invaluable assets, relying on an independent agent you can trust is a great place to start.

Blue Cross of Louisiana's Blue365 deals include big savings on items you use every day to stay healthy. As a member of Blue Cross and Blue Shield of Louisiana or HMO Louisiana, Inc., you can get deals like this one from Tivity Health Fitness Your Way and Fitbit.

$29 Monthly Fee for Access to Network of 10,000+ Gyms Nationwide

THE OFFER: $29 Monthly Fee for Access to Network of 10,000+ Gyms Nationwide and Discounts With Over 20,000 Health and Well-Being Specialists

Whether your goals are physical, such as losing weight and maximizing energy, or emotional like dealing with stress and improving your mood, Fitness Your Way can help you meet your goals, on your budget and do it all on your own time. Fitness Your Way offers access to nearly 10,000 different fitness locations for just $29 a month, as well as other health and well-being specialists and discounts.

- Only $29 per month and a low $29 enrollment fee, with a 3-month commitment

- Get up to 30% off on more than 20,000 experienced health and well-being specialists including chiropractors, acupuncturists, massage therapists, personal trainers, nutrition counselors, yoga and pilates instructors and more

- Save on vitamins, exercise equipment, aromatherapy, organic products, and unique gifts

- Visit any participating fitness location—anytime, anywhere — as often as you like

- Locations include select Anytime Fitness®, Curves® and Snap Fitness®. A limited number of Gold’s Gyms and YMCAs in certain areas are also participating. Use the Fitness Your Way gym locator below to locate gyms near you.

- With 10,000 locations, find fitness classes that fit you and your needs

Join Fitness Your Way now and get a Fitbit device at more than 30% off.

Fitness Your Way offers flexibility, affordability and convenience, with 10,000+ fitness locations nationwide. And now, new members have access to a selection of Fitbit devices at big savings. Follow these steps to enroll online and receive a discount on a Fitbit device:

- Go to blue365deals.com/fyw/bundle

- Click on Login to Redeem or create an account

- After you login, click on Redeem Now

- Confirm your registration

- Choose from up to nine Fitbit devices.

Looking for more discounts? Blue365 has deals for dental care, fitness, healthy eating, mobile phone plans and more. To see all Blue365 deals, register or login at blue365deals.com

We are happy to let you know that Blue Cross and Blue Shield of Louisiana and HMO Louisiana, Inc. members now have 24/7, 365 access to U.S.-trained, board certified doctors with BlueCare, the Blue Cross teleheath service.

For the past few months, doctors have only been available at certain times on BlueCare. Now care will only be a click away, anytime day or night.

For the past few months, doctors have only been available at certain times on BlueCare. Now care will only be a click away, anytime day or night.

Here's how to sign up for BlueCare:

- Go to BlueCareLA.com or download the BlueCare (one word) app for Android or iPhone.

- Create an account with a username and password, which you will use for each BlueCare visit.

- Use your member ID when logging into or creating a BlueCare account.

- BlueCare works on a computer, tablet, smartphone or any device with internet and a camera, and is open to dependents (children, spouse, etc.) covered on your plan.

Archives

June 2023

May 2023

October 2021

October 2020

March 2020

December 2019

November 2019

July 2019

May 2019

December 2018

November 2018

October 2018

September 2018

August 2018

July 2018

Categories

All

Blue365

BlueCare

Blue Cross

COVID-19

Fitness

Go365

Group Insurance

HAFA

Health Agents For America

Healthcare.gov

Health Insurance

Help

Humana

Insurance

Legislation

Long Term Care

Marketplace

Open Enrollment

Tax Credit

Telehealth

RSS Feed

RSS Feed